Not known Facts About Property By Helander Llc

Table of ContentsSome Known Questions About Property By Helander Llc.Getting The Property By Helander Llc To WorkThe Ultimate Guide To Property By Helander LlcThe Definitive Guide for Property By Helander Llc5 Simple Techniques For Property By Helander LlcGetting My Property By Helander Llc To Work

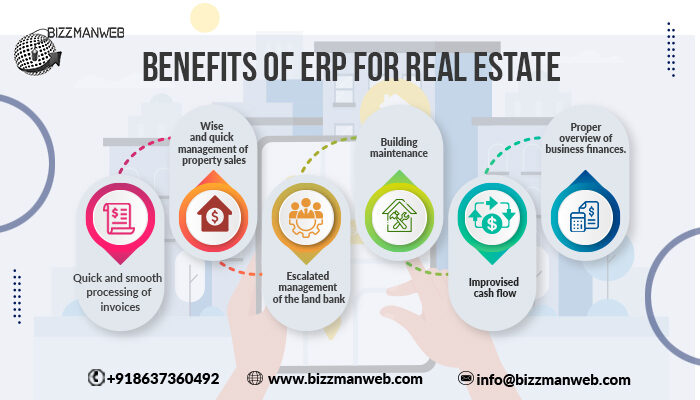

The benefits of purchasing property are countless. With appropriate properties, financiers can take pleasure in predictable cash flow, excellent returns, tax advantages, and diversificationand it's feasible to utilize real estate to build wide range. Considering purchasing property? Right here's what you require to find out about genuine estate benefits and why genuine estate is taken into consideration an excellent financial investment.The benefits of buying property consist of easy earnings, stable capital, tax advantages, diversification, and take advantage of. Property investment company (REITs) offer a means to buy property without needing to have, run, or money residential or commercial properties - (https://www.cybo.com/US-biz/property-for-sale_9n). Cash circulation is the web income from a realty investment after home loan payments and operating expenses have been made.

Oftentimes, cash money flow only reinforces with time as you pay down your mortgageand develop up your equity. Genuine estate financiers can make use of various tax obligation breaks and reductions that can conserve cash at tax obligation time. As a whole, you can deduct the affordable prices of owning, operating, and taking care of a building.

Some Known Incorrect Statements About Property By Helander Llc

Realty worths have a tendency to boost with time, and with a great financial investment, you can make a profit when it's time to offer. Leas likewise tend to rise with time, which can cause greater capital. This graph from the Federal Get Financial Institution of St. Louis reveals average home prices in the united state

The areas shaded in grey suggest united state recessions. Average List Prices of Homes Offered for the United States. As you pay for a residential property home loan, you build equityan property that becomes part of your net well worth. And as you build equity, you have the leverage to buy even more properties and raise capital and riches even more.

Because property is a concrete possession and one that can function as security, financing is easily available. Realty returns vary, relying on aspects such as place, asset course, and monitoring. Still, a number that lots of financiers go for is to beat the ordinary returns of the S&P 500what several people refer to when they claim, "the marketplace." The inflation hedging capability of realty comes from the positive partnership in between GDP growth and the demand genuine estate.

The Buzz on Property By Helander Llc

This, in turn, converts right into greater funding worths. Genuine estate often tends to keep the acquiring power of resources by passing some of the inflationary stress on to lessees and by including some of the inflationary stress in the kind of resources admiration - Sandpoint Idaho real estate.

Indirect actual estate investing entails no straight ownership of a home or residential or commercial properties. There are numerous methods that possessing genuine estate can protect versus rising cost of living.

Finally, buildings funded with a fixed-rate funding will certainly see the loved one quantity of the regular monthly mortgage payments drop over time-- for example $1,000 a month as a fixed payment will come to be much less burdensome as inflation wears down the buying power of that $1,000. Usually, a main residence is ruled out to be a realty investment considering that it is made use of as one's home

The Ultimate Guide To Property By Helander Llc

Despite the help of a broker, it can take a few weeks of job simply to locate the ideal counterparty. Still, property is an unique property course that's basic to recognize and can enhance the risk-and-return account of an investor's profile. On its own, property supplies cash money flow, tax obligation breaks, equity structure, affordable risk-adjusted returns, and a bush against inflation.

Purchasing property can be an exceptionally satisfying and lucrative venture, yet if you resemble a lot of new capitalists, you might be questioning WHY you ought to be buying property and what advantages it brings over various other investment possibilities. In addition to all the remarkable benefits that come with buying actual estate, there are some disadvantages you our website need to think about as well.

The Ultimate Guide To Property By Helander Llc

If you're looking for a way to get into the realty market without needing to invest thousands of thousands of dollars, check out our buildings. At BuyProperly, we make use of a fractional ownership design that permits financiers to begin with as low as $2500. One more major advantage of realty investing is the capacity to make a high return from acquiring, restoring, and reselling (a.k.a.

An Unbiased View of Property By Helander Llc

If you are charging $2,000 rent per month and you sustained $1,500 in tax-deductible expenses per month, you will only be paying tax obligation on that $500 revenue per month (realtors in sandpoint idaho). That's a big difference from paying taxes on $2,000 each month. The earnings that you make on your rental device for the year is considered rental earnings and will certainly be exhausted appropriately